Very few classes that we teach in high school are as important as a Personal Finance class. It’s an invaluable life skill! Developing a Personal Finance course can be overwhelming because there are so many important topics to cover in such little time.

When I was putting together the Personal Finance Course for my students I was careful to incorporate the key components according to the National Business Education Association’s (NBEA) standards and life experiences of my own in personal finance. I definitely didn’t want to leave anything out!

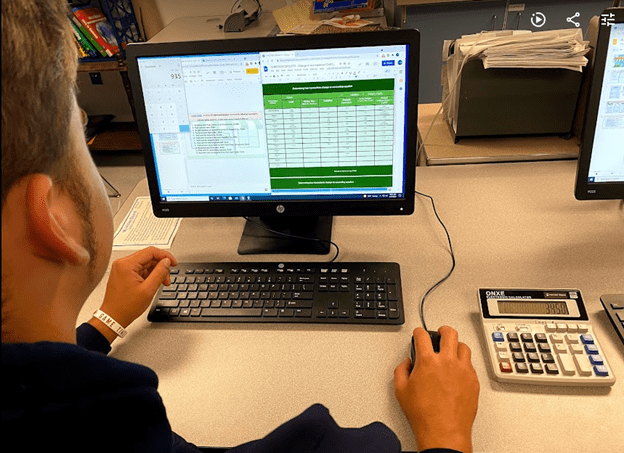

Since I am a multi-prep teacher, I find it so valuable to have a plug-and-play teacher lesson library in order to keep track of the scope and sequence. The Lesson Library is a game changer for time management and organization.

As you can see from the picture below, there are four columns: each unit is captioned and outlined, Video suggestions that are optional but excellent Bell ringers to get the students excited about what concepts were learning, links to each of the student activities, and the teachers keys or a good student example.

Units and Lessons Include:

Career and Income:

Budgeting:

Banking and Money Management Systems:

Paychecks and Payroll Deductions:

Credit Scores and Maintaining a Good Credit Score:

Student Loan Debt, Grants, and Paying for Schooling and Training:

Buying a Car and Car Expenses:

Housing: Renting, Leasing, Buying a Home:

Insurance Options:

Loans and Credit Cards:

Savings and Investments:

Identity Theft:

Consumer Education:

Map Tax Facts:

Free Enterprise Economic System

Bonus Digital Lesson: Financial Advice for Teens from Experts!

This FULL SEMESTER COURSE includes Student-Led material. No PowerPoints needed as all of the information is included to allow the students to discover on their own and present to the class. Also, the Lesson Library includes Formative Assessment Templates that can be edited and customized for any lesson. There are no tests or quizzes included in this resource to allow for teacher autonomy on student assessment.

My freebie vault has over 15 FREE RESOURCES for your classroom when you subscribe to my newsletter.

You will get an email immediately asking you to confirm your email.

If you do not receive the confirmation email, your school’s network has blocked it or it is in your spam folder.

You can sign up with a personal email if your school email was blocked.